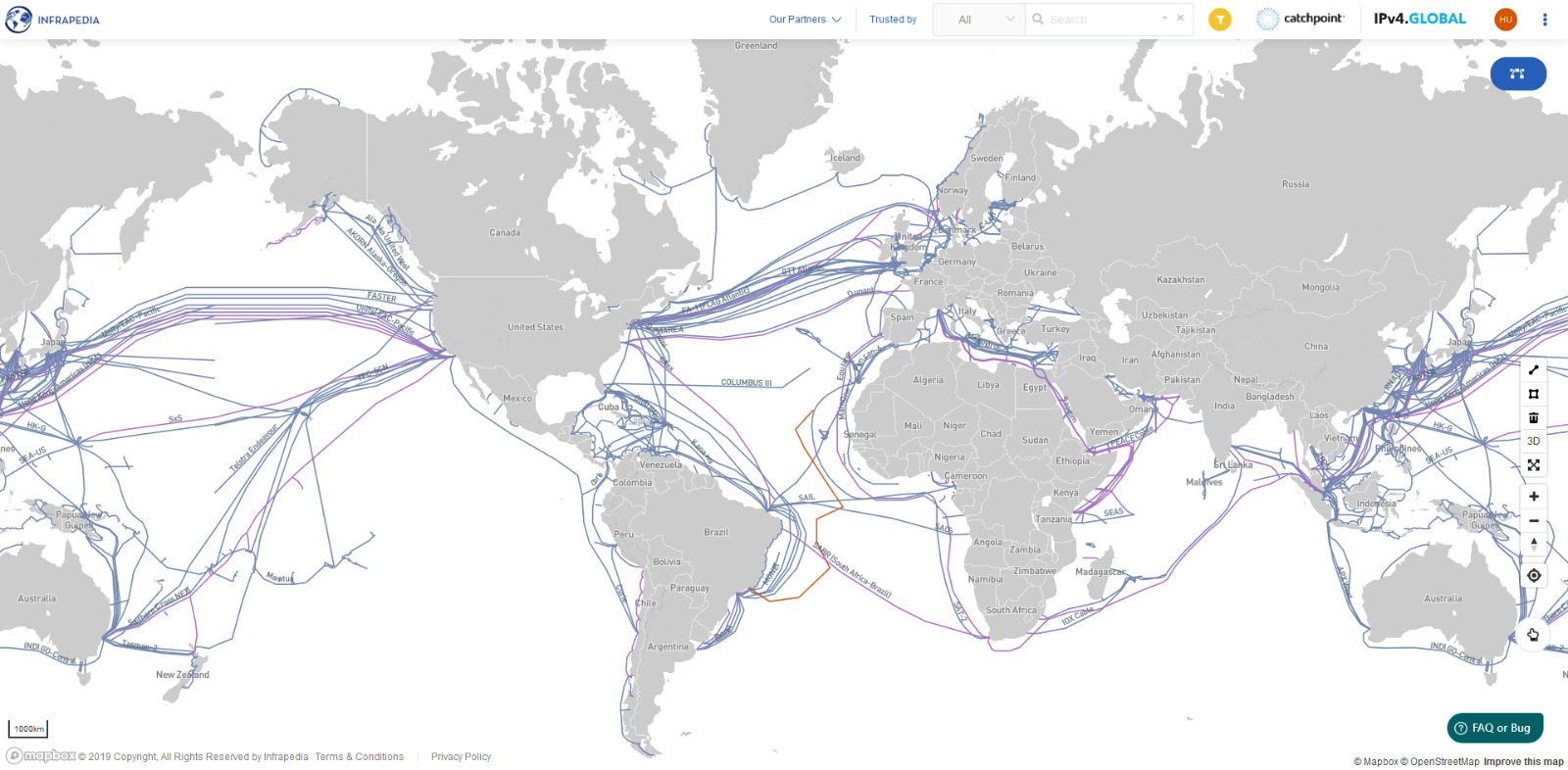

Submarine cables over the last 100 years have played a vitally important role in making the world a smaller place. Today, submarine cables are making the world a smaller connected community as a result of high speed, instant, and effective communications.

Submarine cables continue to carry the majority of financial transactions, social media, government communication, and commerce on an unprecedented level.

Many of us most likely grew up with radio and black and white television prior to the current technological revolution that’s taken place be it cell phones, high-speed broadband at home, streaming videos and near-perfect 4K connections from halfway around the world and no doubt, have a true appreciation for the evolution that has taken place in the last 50 years.

We see submarine cables continuing to play an important role as traffic becomes more direct (i.e. less dependency on a traditional hub and spoke routes of the USA, UK, Japan, etc. as local content continues to be developed).

For example, the Southern Hemisphere is well-positioned to continue to build modern and cost-effective, high-end transmission capacity to the rest of the world. This connectivity will promote further trade and commerce and redefine routing traffic in the very near future.

Looking at the current submarine cable market, prices continue to decline in line with Moore’s Law, yet with the increase in computing power doubling and in some cases tripling, coupled with advancements inline card and LTE technology it’s a testament to the research and development teams around the globe in action.

Many global submarine routes are now offering 100G interfaces replacing the old STM-4 and 10G’s of bygone days. No doubt, 1Tb cards will be available in no time soon.

The Pacific

APTelecom sees the Trans-Pacific market changing dramatically over the next eighteen to twenty-four months. In excess of 40 new fiber pairs will come into service on at least 6 new cable systems, adding over 600 Tb of capacity across the Pacific given new builds underway from HKA, PLCN, B2B, RTI, and other systems not yet announced publicly.

From a routing perspective, the majority of this new capacity is planned between Hong Kong and California, yet we are now seeing the development of routes opening up directly connecting Singapore to California. The aim here it seems to be, is to address the risks associated with the Luzon Strait and the South China Seas.

In the background, India has a desperate need to replace antiquated infrastructure and these new systems planned to directly connect Singapore to the United States may well provide the answer at what appears to be the right time, given the recent announcements of new builds between India and Singapore.

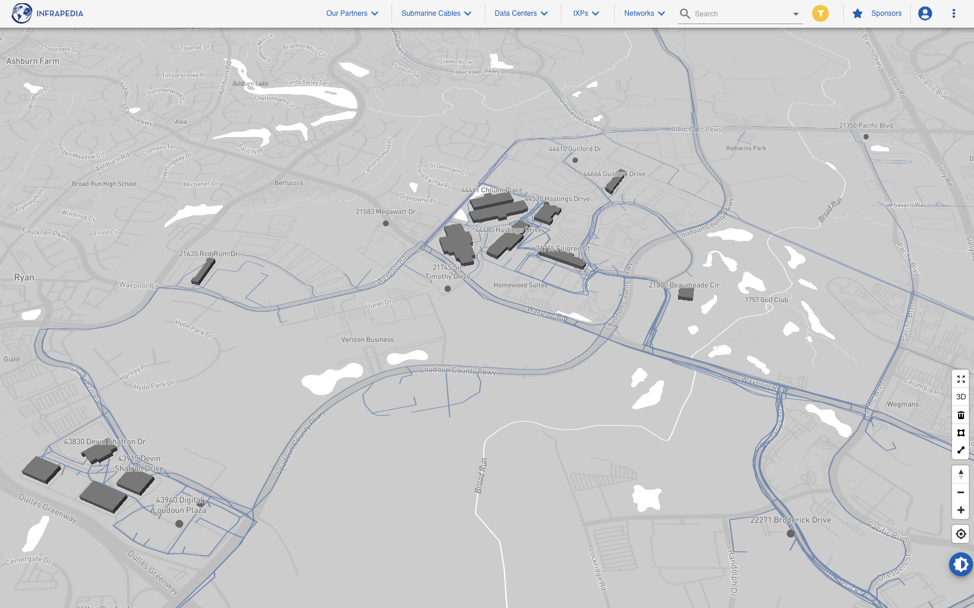

Singapore is also set to face some challenges in our opinion, with multiple new cables planned to land, Singapore is fast becoming the South East Asia single point of failure given the limited number of sites in which cables are currently allowed to land.

An interesting point to consider, is with the amount of capacity coming into service Trans-Pacific will be massively disproportionate to the amount of Inter Asia-Capacity between Singapore, Hong Kong and Japan. This should spur on additional investment in new systems on the thickest routes in Asia, being the ‘triangle’ between Singapore, Hong Kong, and Japan.

SJC2 will simply not be enough, especially if we layer on top of current Asia – US forecast demand coupled with the current moves being made by Chinese content players reaching into South East Asia to grow their businesses, intra-Asia is a long way from being over-serviced with capacity and there is also India’s demand requirements reaching into Asia to consider.

Pricing

APTelecom anticipates Trans-Pacific pricing coming close to parity when compared to the North Atlantic in the mid-term and for the first time, the North Pacific – Asia connectivity and North Atlantic connectivity will have similar pricing scenarios, yet very different demand profiles will continue to prevail.

Asia – US will continue to outstrip EU – US demand due to the ever-increasing teledensity rates, the need for streaming and the rapidly growing user-generated content (UGC) platforms.

Our view of current pricing in the Pacific in 2019:

| 100G | Japan–USA | Australia–USA |

| Lease (monthly) | US$15,000 | US$90,000 |

| IRU | US$600,000 | US$3,2000,0000 |

On average we see 3.5% in O&M fees per annum.

In the next 12-24 months, we will see the Japan – USA pricing decline with -25% CAGR than 2019/2020 pricing while Australia – USA leases 100G will go to US$85,000 (monthly) and for US$3,050,000 for 100G IRUs.

Outlook 2020/2021

Our view of pricing trends in the Pacific in 2020 and beyond:

- Trans Pac will see a greater price decline than what has been a very consistent negative CAGR of 17.5% per annum. It could reach close to 30% or more 2021 onwards or even sooner

- Traditional Trans-Pacific buyers are largely in a ‘wait mode’ to see what happens to price points as this new capacity comes into the market. This is creating opportunity and demand for one- and two-year leases to bridge the timing gap between now and the targeted RFS dates of the new Trans-Pacific systems

- Swapping by non-traditional players is becoming more of a currency and this trend should gather additional momentum as these new systems come into service

- Ownership economics and a cost + model continue to be sought after on new builds for quarter pair spectrum buyers and above

- Diversity remains key, yet finding diverse landings is proving more challenging in particular in locations that are small in landmass – i.e. Singapore. Other parts of Asia may fill this void as concerns remain over SPOF (single points of failure). There is certainly potential for Malaysia and Thailand to act as a bypass to Singapore on routes from India destined for Hong Kong and Japan

- Entitlements such as upgrade rights are becoming more important

- Many pairs may not be utilized initially, and this offers unique challenges in meeting capital recovery targets and O&M obligations over the life of the planned new systems coming into service in the Trans-Pacific

- APTelecom sees migration to 400G and 1Tb Super Channels within 3-5 years or less. This will also add to compound capital recovery challenges for system developers

- Myanmar, Vietnam, Thailand, Indonesia, and Cambodia, regionally known as ‘CLMVT’ remain in need of new and diverse supply and are currently underserved

- Future demand of UGC, IoT, M2M, and in particular AI (Artificial Intelligence) and eGames will drive consumption

- 5G impacts are going to be felt in 2020 and beyond in the Asia Pacific region and will serve to also drive demand intra-Asia and across the Pacific immensely

The long-term challenge in the Pacific will ultimately be build cost economics. Once we reach a point where the price points of capacity cannot justify the cost of building, something will have to give. Either the cost of systems will have to re-align with the cost of capacity or indeed, the price of capacity will need to stabilize.

The Atlantic is just about there now.

Further down the eco-chain, let’s take a quick look at wholesale capacity sellers. Are the days of wholesale arbitrage over? APTelecom doesn’t believe so. There will always be new entrants looking to obtain SDH style services. We will see the emergence of more gaming and movie platforms tailored to specific markets and we are also fielding requests for SDH capacity from large enterprises that would traditionally buy layer 3 services from carriers. As the market becomes savvier and less dependent on carriers’ muxing services, these ’new players’ will most likely replace the old guard.

Conclusion

In summary, the future for the trans-Pacific appears set to shift to an over-supply and depressed pricing cycle. However, just like the bottom of the last boom cycle, the industry will continue to innovate and adapt in the face of the challenges identified above.

We hope you enjoyed this report which at some point the bits to enable viewing are being delivered over a submarine cable in some depths of the ocean across the planet!

Author Bio

ERIC R. HANDA is Co-Founder and CEO of APTelecom and a member of the Advisory Board for Infrapedia. As Co-Founder and CEO, ERIC R. HANDA has built APTelecom into a globally recognized leader in telecom consulting.

Since launching in 2009, Handa has grown APTelecom from a start-up business to an award-winning global organization that has generated over the US $315 million in sales for clients.

Handa has been instrumental in helping APTelecom achieve scale on a global level, client reach now covers every continent on the globe, and along with other APTelecom executives, Handa has made in-country visits in more than 50 countries to support clients across the world.

Handa is an experienced telecommunications executive with expertise spanning global management, sales, and leadership roles. Prior to founding APTelecom, Handa worked for AT&T, Tyco Electronics, Tata, and Bharti Airtel in a number of senior operations, research, and sales assignments. Handa is a Pacific Telecom Council (PTC.org) innovation awards judge.

APTelecom has also developed a culture of giving back and established its signature “State of Subsea” series, which is a 501c charity. APTelecom has donated more than 10% of its profit annually since its inception (www.stateofsubsea.com). Handa is an avid supporter and volunteer of Habit for Humanity and Bloom Again Foundation.

www.aptelecom.com

Contact Eric:

+1.908.547 7868

eric@aptelecom.com[/vc_column_text][/vc_column][/vc_row]